Enhance Oversight. Reduce Operational Risk.

CXC empowers lenders with an integrated suite of products to monitor every individual loan in a collateral pool, validate documentation in real time, and stay ahead of risk.

Top Lenders Work with CXC

Because of our proven track record and unmatched ability to deliver transparency, control, and speed across complex credit facilities

Full Backup to Ensure Operational Continuity

Key products

Together, they form CXC s full stack Master Servicing offering built to handle complexity with confidence.

Verification Agent

Validate every document and every loan, powered by AI. Ensure consistency between the information contained in documents and the data registered in the data base.

Collateral Agent

Safeguard the assets. Enforce the structure. We oversee and monitor the collateral with full transparency and legal precision.

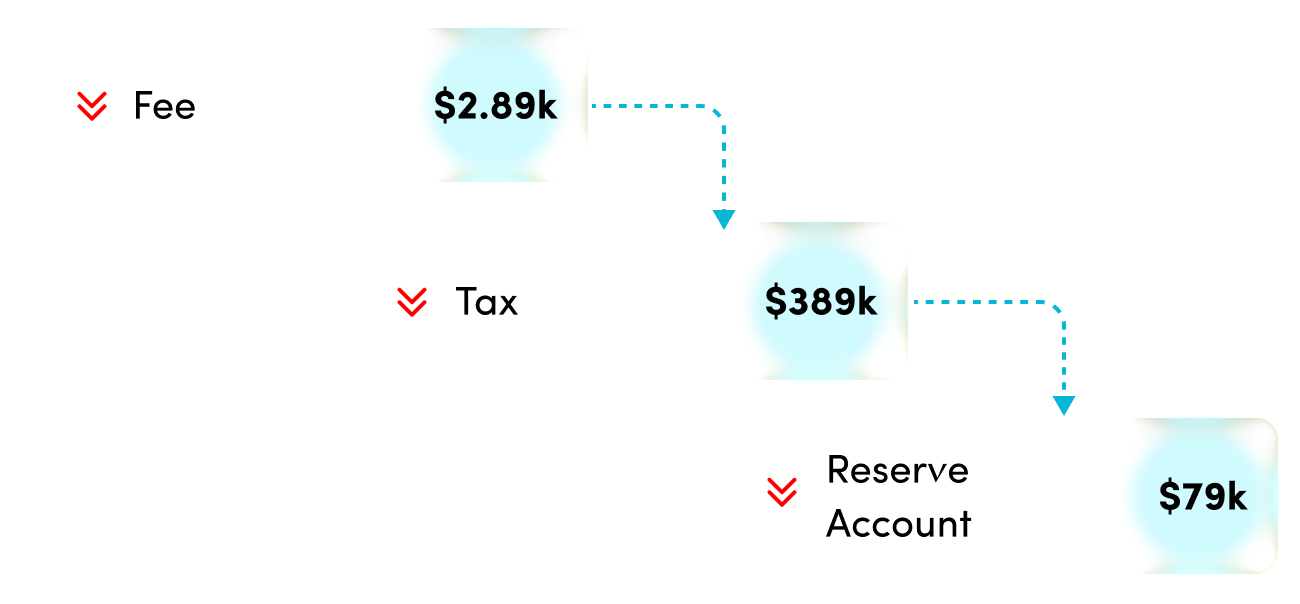

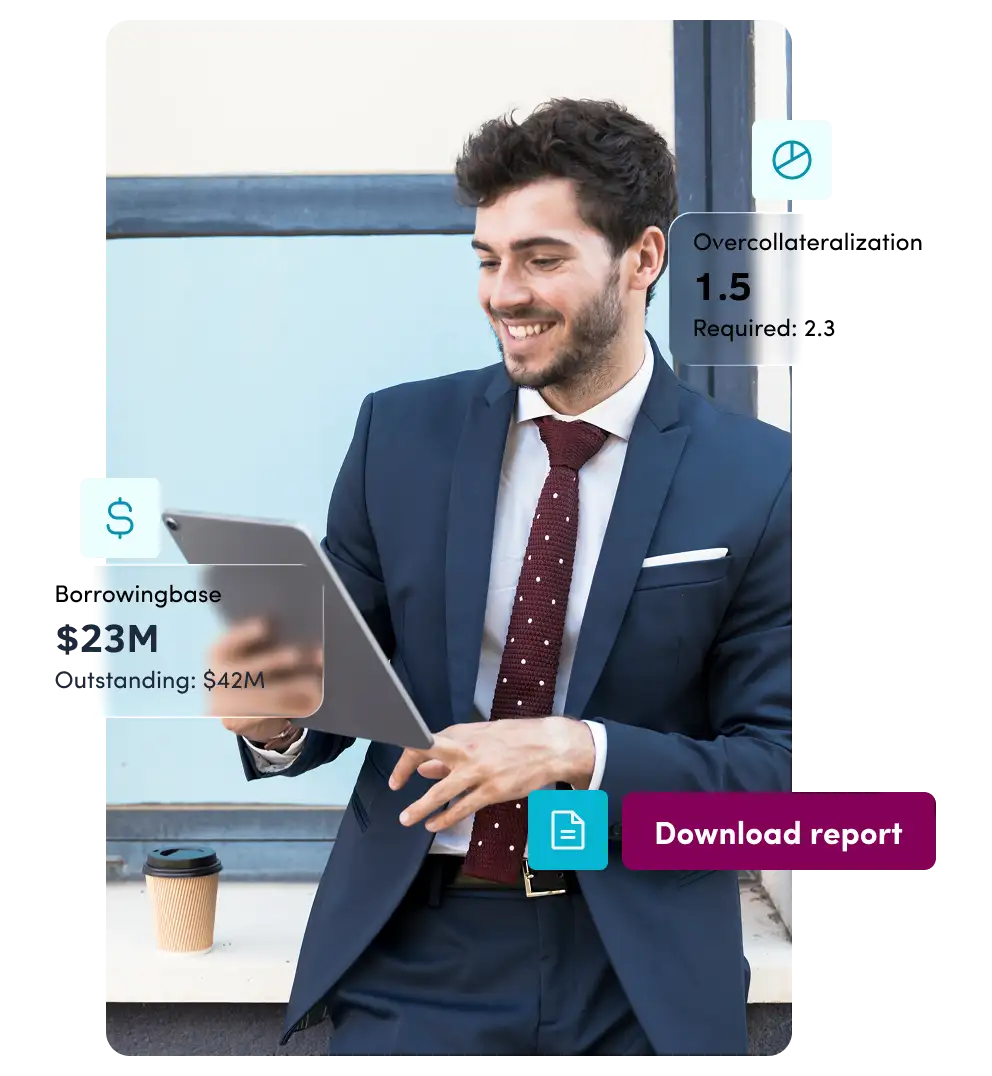

Calculation Agent

Complex calculations made simple. We automate the calculation of fees, reserves, borrowing base, waterfalls and monitor triggers with precision.

Backup Servicer

Your continuity plan in action. We maintain a live, ready to activate replica of the portfolio, ensuring seamless takeover, if needed.

Tax Agent

Navigate tax filings and compliance. We manage fiscal responsibilities so transactions stay clean and compliant.

Administrative Agent

Coordination made effortless. From notices and approvals to document handling, We ensure smooth communication between all parties

Technology + Trust = An exceptional experience

Value

We are more than just technology and service, we unlock capital efficiency.CXC reduces friction, accelerates funding, and protects investor returns across every structured finance transaction.

Trust

Chosen by leading lenders, funds, and originators. We operate with integrity, neutrality, and complete transparency ensuring confidence across all counterparties.

Experience

A team of over 200 professionals who have seen it all. With deep roots in structured finance, legal, credit, and operations, our people bring the knowledge and precision your transactions demand.

Continuity

Business as usual, Even when things are not. Our backup servicing capabilities ensure your operations stay on track, no matter what. We re built for resilience.

Who we serve

CXC’s Master Servicing solution is built for institutions navigating the complexity of private credit and structured finance. We support those who demand precision, transparency, and deep regional expertise with the technology and team to match.

Institutional Lenders and Private Credit Funds

Looking for real time visibility, portfolio level control, and streamlined execution.

Trustees and Fiduciary Service Providers

Who need a reliable, tech enabled partner to manage collateral, calculations, and reporting.

Non-Bank Financial Institutions and Fintechs

Operating a portfolio of loans operating under structured finance financing models, requiring operational scalability and investor grade reporting

Transform audits from a pain point into a competitive advantage.

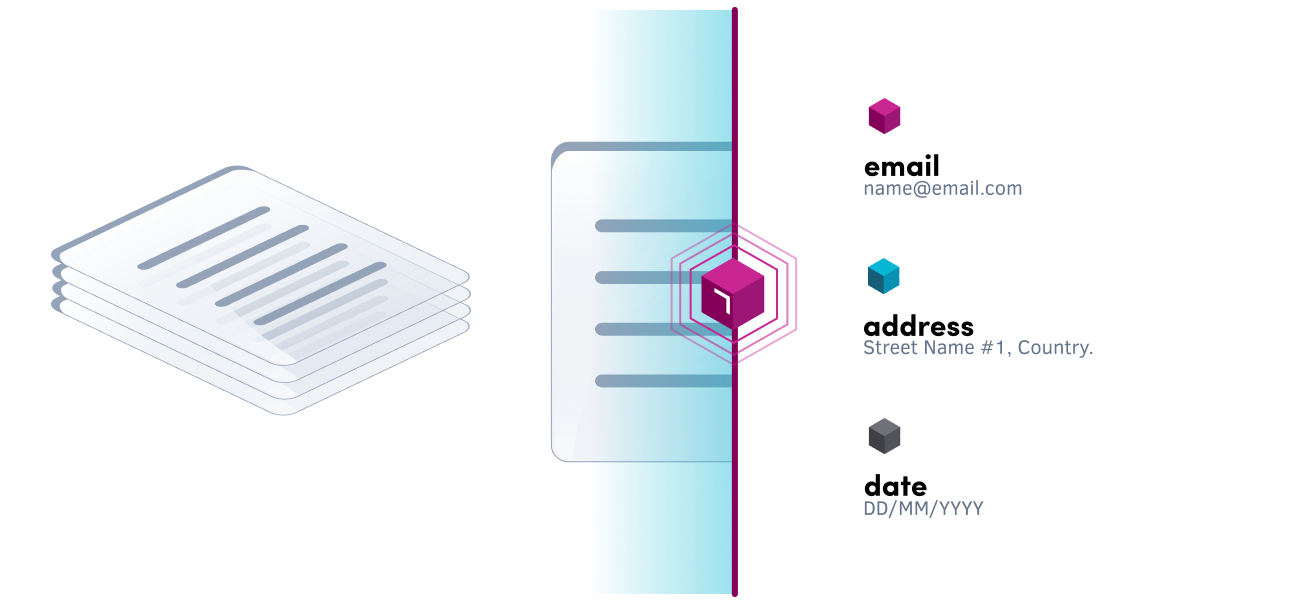

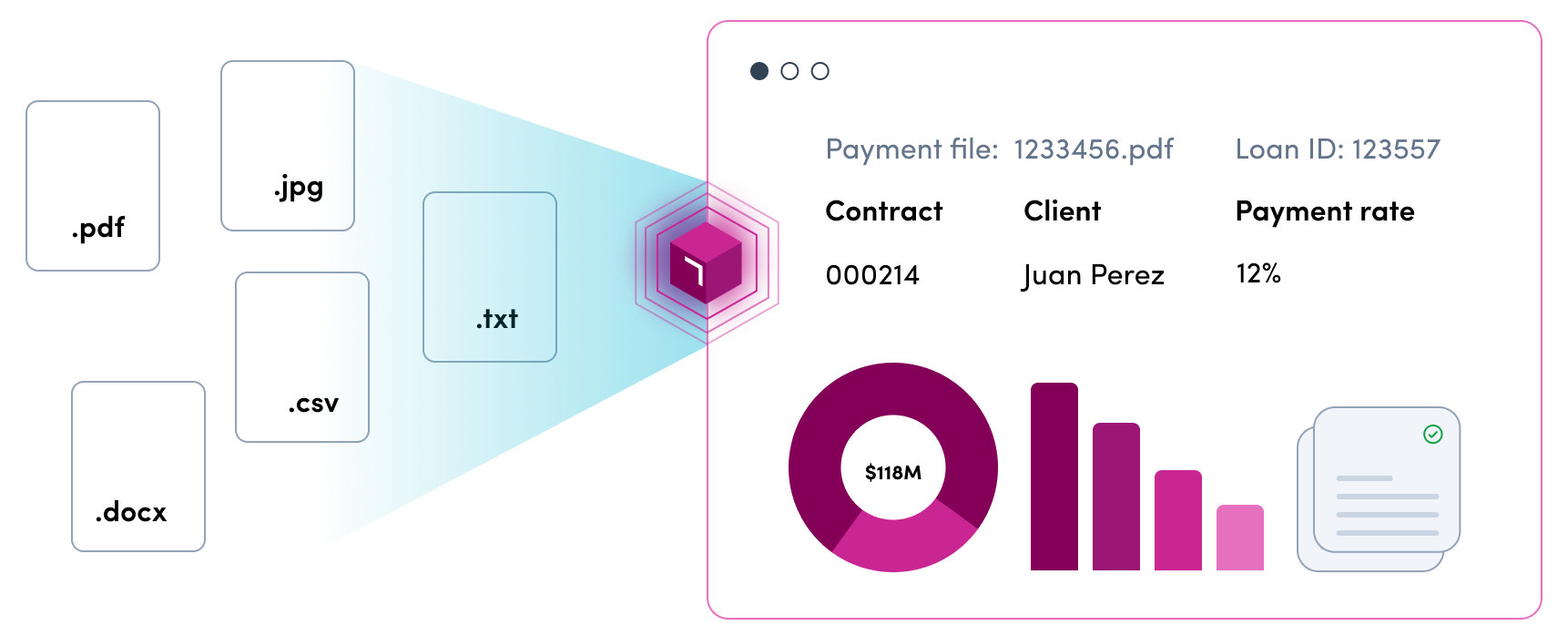

With CXC’s AI-Powered Verification Agent, loan document reviews are no longer a bottleneck in the asset-to-liquidity process. Our technology enables you to validate the entire portfolio

- Verify 100% of the files, not just a sample, securing your collateral, automatically and at scale

- Accelerate disbursements without compromising on rigor or compliance

- Increase certainty and reduce operational risk without adding friction

Frequently Asked Questions

Have questions about our services or how we operate? Here are quick answers to help you understand what working with CXC looks like.

What level of visibility does CXC provide into the collateral pool?

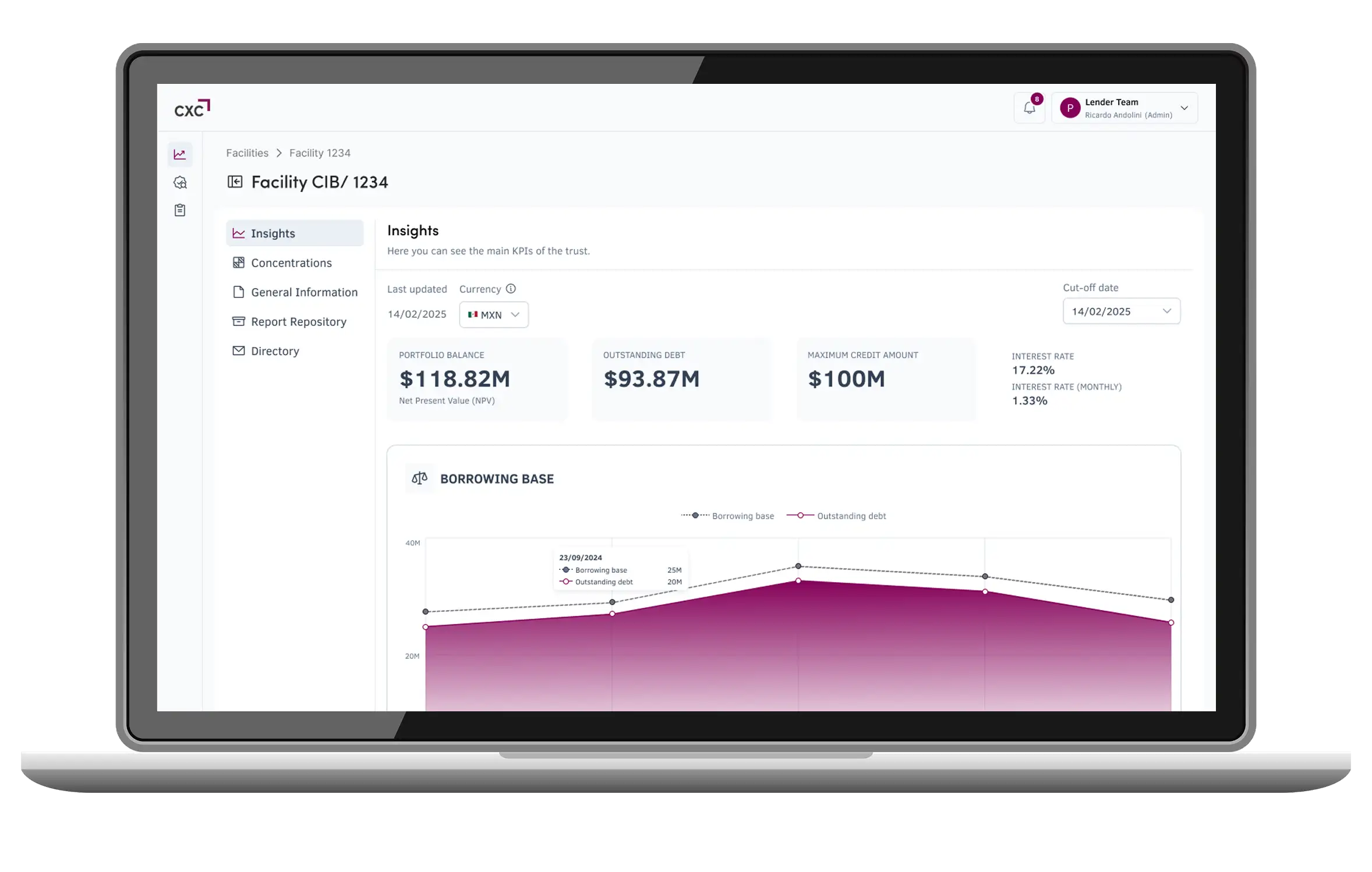

CXC tracks every individual future flow that derive from every single loan directly from the source of information, with no reliance on loan tapes. You get full transparency on asset performance, eligibility, and compliance across the life of the facility.

Can CXC support my internal reporting and audit requirements?

Yes. Our platform includes customizable reports, as well as a web based reporting dashboard, and audit-ready reporting tools, making it easy to comply with any reporting needs.

Is your platform suitable for multiple geographies?

Absolutely. CXC supports multi-jurisdictional and cross-border transactions, with full flexibility to adapt to local legal frameworks, and reporting requirements. Whether you’re operating in one country or across several, our platform delivers consistent oversight and compliance across regions.

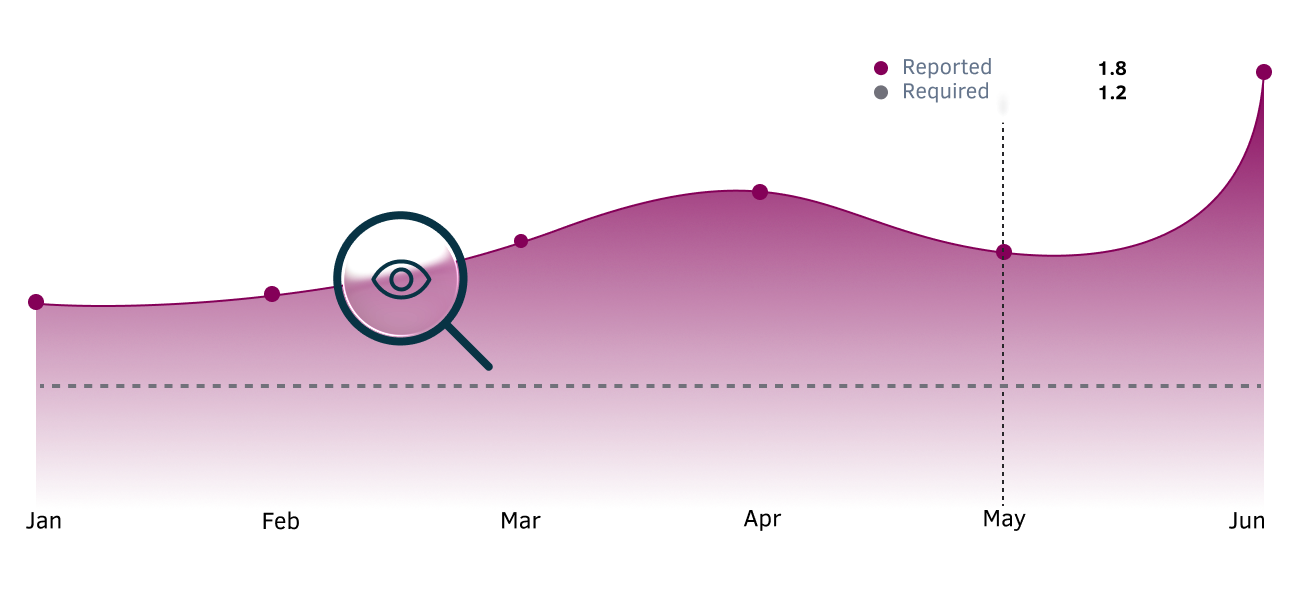

How does CXC help detect risk or covenant breaches?

Our platform includes real-time alerts and exception monitoring, flagging issues like ineligible assets, covenant breaches, or concentration drift-before they escalate.

How secure is the data shared with CXC?

We follow bank-grade security protocols, including role-based access, encryption at rest and in transit, and secure document storage. You stay in control of who sees what.

One Platform. Every Deal. Total Visibility.

When you manage multiple facilities information can become fragmented. CXC solves that by bringing everything together in one centralized platform.

Consolidated Portfolio View

Monitor all your credit facilities across originators, asset classes, and geographies from a single dashboard. Instantly access KPIs, risk metrics, and performance in one unified space.

Better Risk Assessment

Our platform gives you standardized, real time data across your entire book, making it easier to compare performance, spot trends, and act on early warning signs before they escalate.

Operational Consistency

With CXC, every deal runs on the same rails streamlining onboarding, automated verifications, consistent reporting, and audit ready records.

Cleaner Reporting, Easier Oversight

From investor updates to regulatory compliance, having all your deals in one place means faster reporting, reduced errors, and fewer surprises.

Let CXC be your command center for all structured finance operations

Let’s Build Better Credit Structures Together

Ready to strengthen your debt servicing process? Partner with CXC to bring accuracy, transparency, and operational efficiency.