Master Servicing of Debt Trusts

Ensure seamless operations, compliance, and stakeholder confidence with our end-to-end debt trust servicing—powered by advanced automation and regional expertise.

Comprehensive Servicing for Complex Debt Structures

CXC serves as the operational backbone for structured debt facilities across Latin America. We handle everything from trust onboarding and data intake to disbursement management, compliance tracking, and real-time reporting—so you can focus on growing your portfolio.

Our master servicing framework is powered by ARIA, our proprietary platform, which automates workflows and delivers full transparency to originators, trustees, and investors alike. Whether you’re managing one facility or a cross-border portfolio, we provide the structure and control you need to scale with confidence.

Key Features

Regulatory & Contractual Compliance

Automated rule-checking and audit trails ensure you stay aligned with local and international standards.

Disbursement & Waterfall Execution

Timely, accurate payment flows based on predefined waterfall logic.

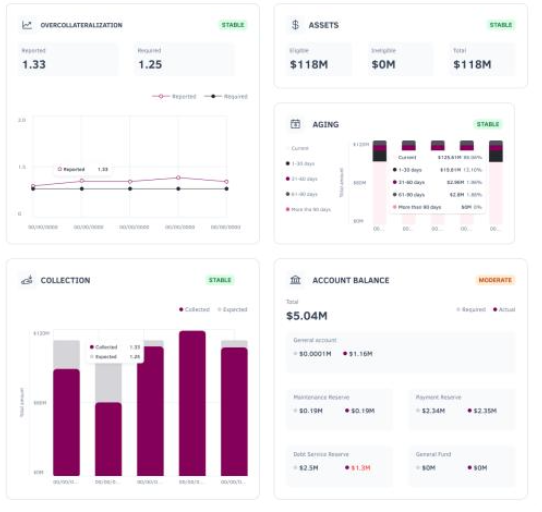

Stakeholder Reporting

Real-time dashboards and exportable reports for all parties involved.

Trust Account Management

Secure handling of cash flows and collections through centralized structures.

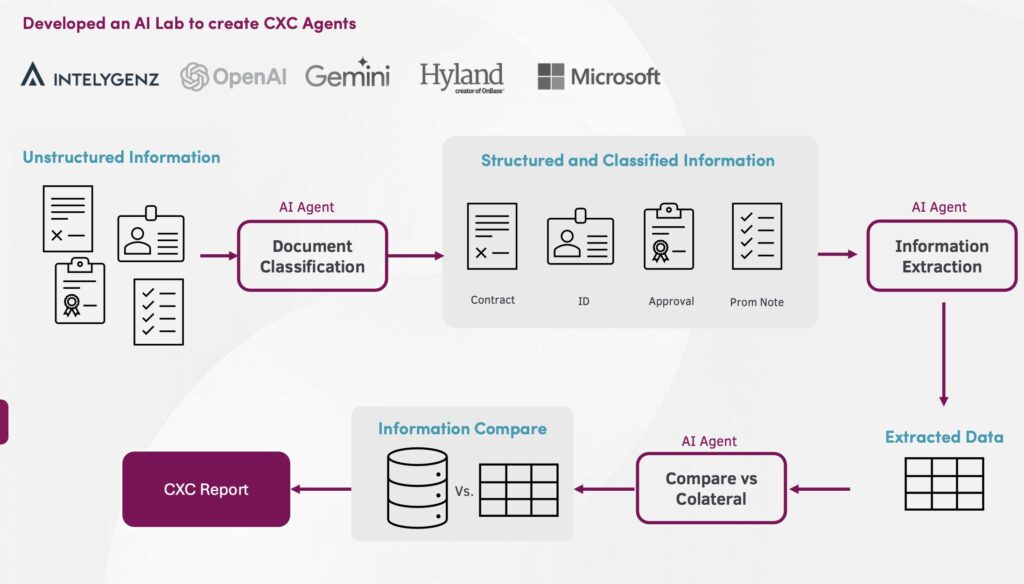

AI-Powered Data Integrity

All borrower and facility data are continuously monitored for consistency and anomalies.

Who It’s For

Our master servicing solution is built for institutions managing complex debt facilities who require precision, transparency, and regional expertise.

- Institutional lenders and private credit funds

- Trustees and fiduciary service providers

- Non-bank originators operating under structured finance models

Frequently Asked Questions

Have questions about our services or how we operate? Here are quick answers to help you understand what working with CXC looks like.

What does master servicing of debt trusts include?

It covers the full operational management of debt facilities—from trust setup and cash flow handling to compliance and reporting.

Is this service suitable for cross-border or multi-jurisdictional deals?

Yes. Our team supports regional and international transactions, ensuring alignment with local regulations and global best practices.

How does CXC ensure transparency for all stakeholders?

Our platform provides real-time access to dashboards, automated reports, and data integrity checks for originators, trustees, and investors.

Can you customize servicing workflows for our specific facility structure?

Absolutely. We tailor servicing processes based on your legal, financial, and operational requirements.

How quickly can CXC onboard a new debt trust?

With ARIA and our experienced team, onboarding can be completed in a matter of days—without compromising quality or control.

Let’s Structure Success Together

Ready to streamline your debt servicing process? Partner with CXC to ensure accuracy, efficiency, and trust across every transaction.