Simplify Execution. Unlock Capital Faster.

Automate operations, accelerate disbursements, and build stronger relationships with your lenders—all from one platform.

Top originators work with CXC

Whether it’s your first institutional line or a multi-facility program, we work with you to ensure smooth execution and lender-grade transparency.

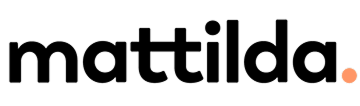

One platform. All your Deals. Maximum efficiency

Running all your transactions on CXC gives you a single source of truth. Monitor performance across facilities, standardize compliance, and reduce the operational burden on your team—all while giving lenders a clear, consistent view.

- Centralized operations for multi-line borrowers

- Consolidated portfolio insights & risk detection

- Faster lender approvals and better positioning

- Scalable workflows for originators of all sizes

Why the Markets Top Players Choose CXC

CXC isn’t just a servicing platform—it’s a complete infrastructure for managing, scaling, and optimizing your structured finance portfolio. Our technology delivers real-time insights, powerful automation, and operational certainty for all stakeholders.

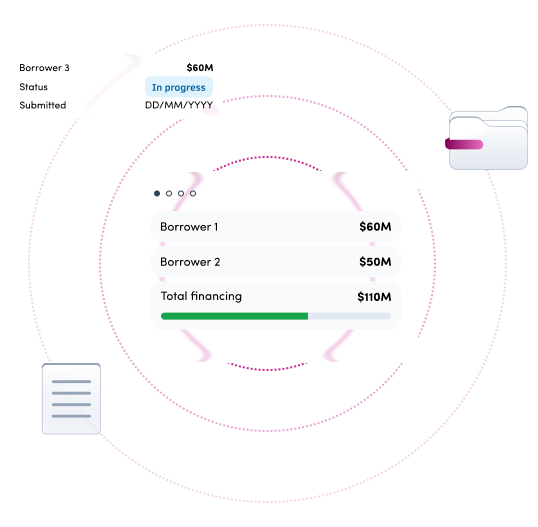

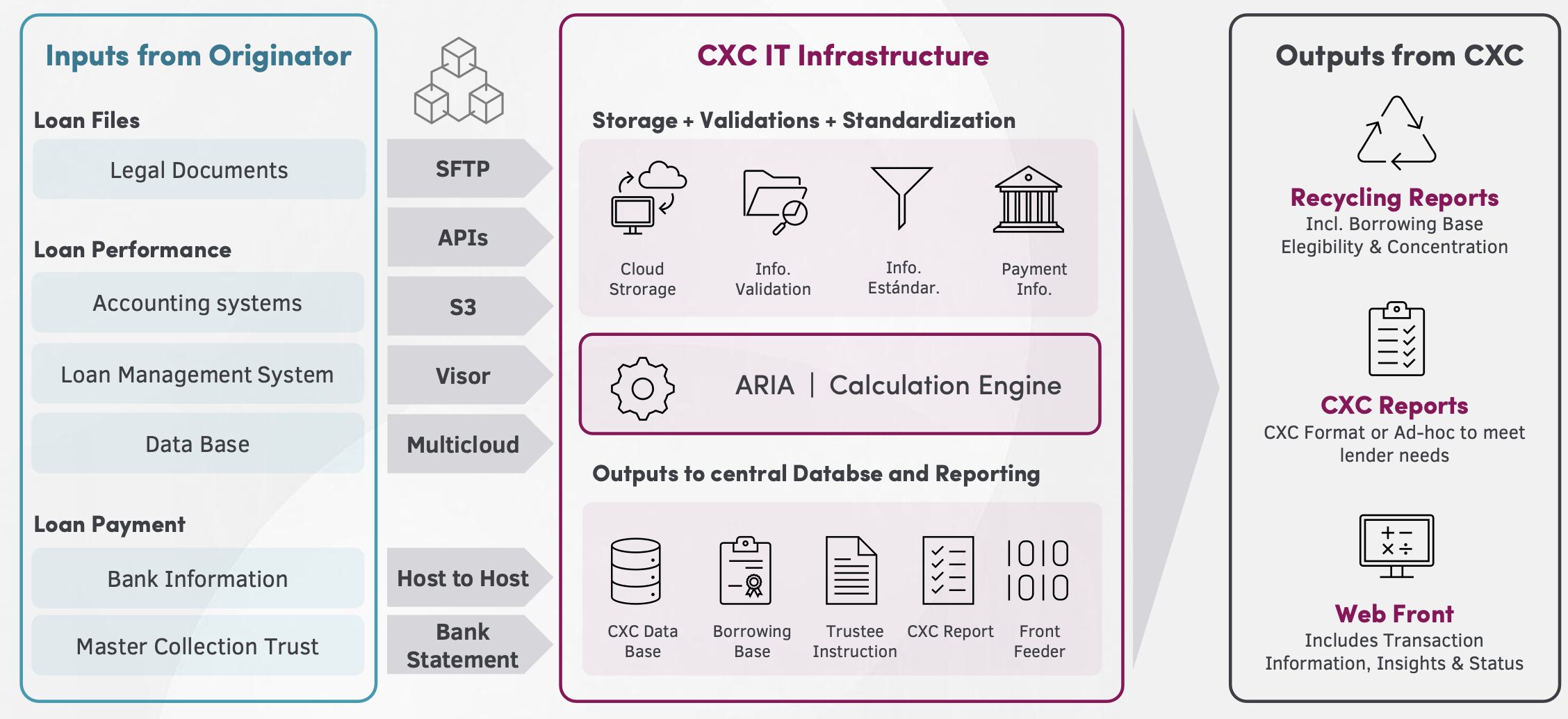

Seamless Integrations

Connect effortlessly via API, webhooks, or SFTP. Whether you're working with legacy systems or modern tech stacks, CXC adapts to your setup—or helps you evolve it—so you can unlock the full power of digital operations.

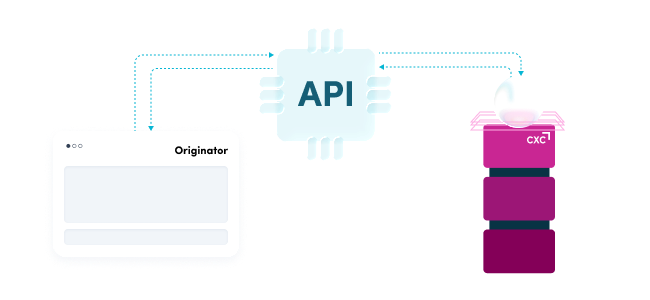

Frequent Distributions

Automate cash flow execution and waterfall calculations with speed and accuracy. We support daily reconciliations and distributions, improving transparency and reducing idle capital for both borrowers and lenders.

AI-Powered Verification

Accelerate audits, onboarding, and compliance with our proprietary AI Verification Agent. It parses, extracts, validates, and organizes documents instantly—eliminating manual reviews and reducing operational drag.

Due Diligence Tool

Provide auditors and lenders with secure, real-time access to a fully auditable data room. Track asset eligibility, covenant compliance, and historical performance in a permission-controlled environment.

Portfolio Tracker and Optimizer

Monitor and manage all your facilities in one place. Gain real-time insights into asset performance, concentration limits, and covenant metrics—so you can maximize equity and anticipate risks before they surface.

The CXC Difference: What sets us apart isn’t just what we do — it’s how we do it.

Technology

Our platform is purpose-built for structured finance— integrating APIs, calculations, and AI-powered verification into one seamless system. No matter the size or complexity of your transaction, our team can solve any technological challenge with speed and precision.

Innovation

We don’t follow trends—we shape them. Our dedicated Product team is constantly improving the way private credit is structured, embedding automation and intelligence into every layer. CXC is building the digital railways of private credit in Latin America.

Experience

With over 200 professionals, CXC is the go-to partner for structuring complex transactions. Trusted by law firms and trustees, we’re often brought in to define operating mechanics. Our goal: to be the oracle of structured finance in every market we serve.

Trust

We power some of Latin America’s largest structured finance transactions and credit platforms. Lenders, originators, and fiduciaries choose CXC for our neutrality, transparency, and execution certainty—deal after deal.

One Platform. Every Deal. Total Visibility.

CXC offers a suite of advanced software modules that support originators, CFOs, and finance teams in managing their debt portfolio.

Consolidated Portfolio View

Gain a 360° view of your financing ecosystem. Centralize the oversight and analysis of your entire financing portfolio. Track distribution of facilities, segment data to assess concentration risks, and validate eligibility criteria. Includes a vintage analysis engine to evaluate performance over time and a pro forma modeling tool to simulate new debt.

Better Risk Assessment

Turn financial controls into a competitive advantage. Automate KPI and covenant monitoring, generate audit-ready reporting, and reduce manual interventions. This module enhances transparency and confidence for all stakeholders.

Operational Consistency

Real-time control for CFOs and capital markets teams. This module provides visibility into your debt portfolio, outstanding balances, transaction-level costs, and calculating your Weighted Average Cost of Funds (WACF).

Cleaner Reporting, Easier Oversight

Raise capital with confidence and clarity. Includes a secure data room, automated KYC material exchange, and a dynamic company profile builder. Simplifying execution while safeguarding sensitive information.

Let CXC be your command center for all structured finance operations

Frequently Asked Questions

Have questions about our services or how we operate? Here are quick answers to help you understand what working with CXC looks like.

What support does CXC provide if this is our first structured transaction?

We understand many of our clients are entering structured finance for the first time. CXC becomes your partner from day one-guiding you through onboarding, documentation, and operational setup to ensure a smooth, confident execution.

How long does it take to set up and go live with CXC?

We move fast. Most borrowers can be onboarded in as little as 2-3 weeks, depending on the complexity of the structure and data availability. Our onboarding team will work with you closely to ensure a quick, efficient launch.

Will we need to change our internal processes or systems?

Not at all. Our platform is built to adapt to your workflows, not the other way around. We offer API, SFTP, and CSV/XLS-ready input templates integrations so you can stay operationally comfortable while gaining all the benefits of automation and compliance.

I already work with a Master Servicer. Can I still work with CXC?

Yes. We often collaborate alongside other Master Servicers-either as a Verification Agent, Backup Servicer, or to support specific components of the transaction. Our modular approach allows you to integrate CXC into targeted parts of your structure without disrupting your existing relationships.

And if you’re considering a transition from your current provider, we can help you navigate that process smoothly and without operational risk.

Can I engage CXC even if I don't have a credit facility yet?

Yes. Many clients engage CXC before securing a credit facility-whether to implement our Portfolio Tracker or to set up a Collections Trust in anticipation of institutional funding. We help you structure your operation from day one, strengthening your position with lenders and accelerating execution once financing is approved.

Whether you’re preparing your first transaction or laying the groundwork for a scalable program, CXC is here to support you every step of the way.

Let’s Build Better Credit Structures Together

Talk to our team to see how CXC can streamline your first (or next) structured transaction.