Services

Empowering institutions with end-to-end structured finance solutions built for trust, speed, and transparency.

Master Servicing of Debt Trusts

We manage and oversee structured debt facilities from end to end, ensuring full regulatory compliance and operational continuity.

Backup Servicing

In the event of servicer disruption, CXC ensures uninterrupted operations with automated, AI-powered backup servicing you can rely on.

Master Servicing of Collections Trusts

CXC streamlines collections processes and disbursements through secure, scalable trust servicing—keeping your capital flowing.

Audit Services

Stay compliant and confident with real-time portfolio audits, transaction-level verification, and structured finance expertise.

Frequently Asked Questions

Have questions about our services or how we operate? Here are quick answers to help you understand what working with CXC looks like.

What types of structured finance services does CXC offer?

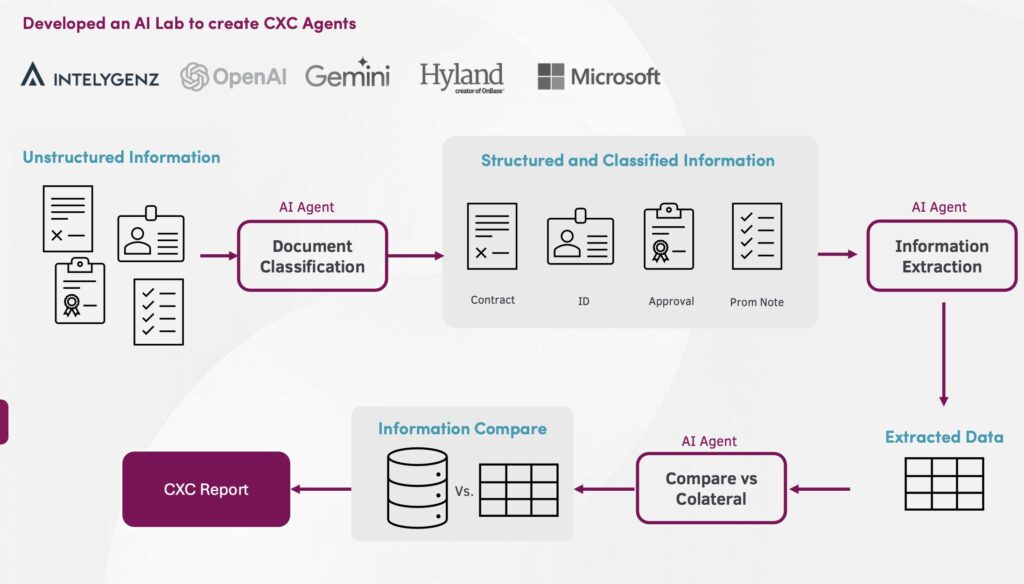

CXC provides end-to-end operational support, including master servicing of debt and collections trusts, backup servicing, and audit services—powered by our proprietary platform, ARIA.

How does CXC ensure compliance and transparency in servicing?

Our AI-driven platform automates regulatory checks, real-time data monitoring, and stakeholder reporting to ensure every transaction meets legal and contractual standards.

What happens if the primary servicer fails?

In case of disruption, CXC’s backup servicing activates seamlessly—preserving data integrity, continuing collections, and maintaining trust with lenders and investors.

Can your services be tailored to our facility or jurisdiction?

Yes. Our modular platform and team of experts adapt to your structure, local regulations, and operational needs across Latin America and beyond.

Who are your services designed for?

We work with institutional lenders, originators, trustees, and investors involved in private credit, ABS, and ABL structures—supporting transactions of all sizes.

Let’s Simplify Your Next Structured Finance Deal

Whether you need full-scope servicing or specialized support, our team is ready to help. Discover how CXC can streamline your operations and reduce risk from day one.